Cognitive distortions

Today I want to play smart but don’t worry I won’t let you get lost in an unfamiliar vocab. I’ll do my best to break it down into simple terms and literally draw you a map to stay tuned.

Let’s talk about cognitive distortions

It has nothing to do with stupidity or small-mindedness.

This is about the patterns of thinking inherent in each person. They cannot be explained logically, because they appeared in the process of evolution: the spine straightened, the tail fell off, certain shifts occurred in the brain processes, but all in all nothing drastic or global. Therefore, for the time being, we retain in ourselves the traits of animal thinking.

The more finely tuned our psyche is, the more protective mechanisms it develops so as not to go nuts from everything that the outside world overloads it with.

This is neither good nor bad. Just accept it as a fact that you cannot change.

You cannot adjust the features of a person’s psychology, but you can be aware of them and track in yourself when they interfere with your trading on the stock exchange.

In fact, these crooked patterns do not matter, but I will only talk about those that interfere with traders.

And again: these are no bugs. These are features. You just need to learn how to deal with them.

Stay persistent in justifying your choice

If you consider someone to be as stubborn as a mule, you might as well be one yourself. People tend to justify their choices with rational arguments. If it doesn’t work out rationally, then all sorts of conspiracy theories pop up in no time.

Let’s Imagine that you took a profit a bit early and now you find yourself sitting and watching the price continuously go up.

Obviously, you let your ratio kick in and start comforting yourself:

- “Something is better than nothing.”

- “I took off on the breakdown just at the right time before everything went south.”

- “I religiously followed the telegram recommendations. It’s not me who made a mistake, blame it on the blogger.”

It’s somewhat ok to be that way. But when you start denying that it was initially your screw-up that’s when you gotta be alarmed. There is no way you can fix a problem without realizing your own mistakes.

A true red flag kicks in when auto-training does not help and you begin to justify your failure as a planned conspiracy of crypto channels and the exchange. In case, such thoughts start clouding your brain- this is a sign you are losing your mind.

How to deal with it?

Every time you are overwhelmed, just say it out loud: “I did this because it made sense in that situation. And I can do it again if it seems reasonable to me. But that doesn’t mean I’ll always do that.”

A snowball effect

This is the tendency of any person to believe what most of their inner circle or community believes.

This distortion is best illustrated by the phrase “When the crowd ran, I followed.”

I bet you know the golden rule of any exchange: lemmings flocking – it’s time for cropping. It’s just about this cognitive distortion. About a crowd instinct.

Anyone who has learned to suppress the crowd instinct in its budding phase has obtained a super skill to sense the change of a trend in a matter of seconds. So when it’s even your mom that becomes interested in Ethereum prices that’s like legit warning to set limit orders.

As the legendary Warren Buffett said, “Be fearful when others are greedy and be greedy when others are fearful”. I advise you to follow this rule in order to be successful.

How to overcome the crowd instinct?

Regularly ask yourself a question: “Is this what I think, or is it some pseudo crypto pros that think so?” Separate your experience and intuition from others. Try to avoid collective decision making. When it comes to trading, it’s every man for himself. DIXI

Faith in the law of small numbers

It’s a habitual thing to make assumptions while owning bits and pieces of info at hand and to exaggerate certain notions as if they are reflecting the whole picture.

As they say: “Once an accident, twice a coincidence, three times a pattern”.

Right?

If you agree then, they already got you on the hook.

In fact, this is not a pattern. Tails can fall in 8 cases out of 10. But in the same way, you can only bet on red and lose all the time.

Here are some up to date examples on how this distortion gonna get the lemmings burnt badly pretty soon:

- Dogecoin has grown 20 times in a year. It was promoted by Elon Musk.

- Shiba Inu has grown almost 40 times in a year. Elon Musk often writes about this coin on his Twitter.

- DogeZilla entered the market with the exact same dog pic and the project team is posting photos with Elon Musk. So this dog Godzilla will also rise in price at least 20 times.

Unsubstantiated confidence in Musk’s ability to push up any kind of stuff led to the fact that shitcoin increased its capitalization from $50,000 to $350,000,000 in a week because of the rush demand.

How many of the buyers asked themselves the question: “Does Elon even know about this coin?”

How to deal with this pattern?

The only way is to continue collecting info. And always keep it in mind: “Once an accident, Twice a coincidence. And when it happens for the third time, it’s worth making sure that no one is trying to fool you and make you believe in a pattern.

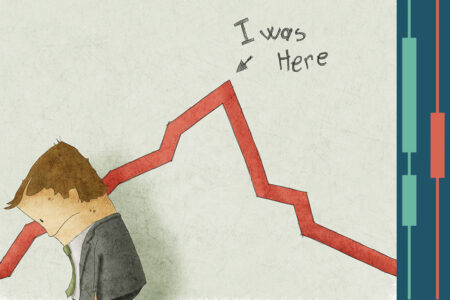

Incurred Expenses & Memory of them

This is somewhat reminiscent of an unclosed gestalt or unfinished action.

Unprofitable cases will always remain in your memory and they will influence your decisions in the future. Losing 100 dollars will affect you much more than the income received for the same amount.

It doesn’t matter that you have already covered losses and gained profit a long time ago. Memory will play tricks with you and it may be challenging to make a decision. As a result, you will go in cycles trying to not lose again and calculating how to get more will no longer be a priority.

They say the psychological shock of a loss is several times stronger than the joy of profit.

How to deal with it?

In this case, I’m the one to help you.

I can manage risks and minimize losses. I will calculate the possible risk from the transaction and you can chill because the loss is no longer your problem. Therefore, thoughts about the lost money will not cloud your mind during your sleepless nights. Well almost.

May profit, trustworthy provider & common sense be with you!

Your witty buddy, Letit

Join our Linkedin channel to stay updated on the latest news!

Subscribe

Join our Linkedin channel to stay updated on the latest news!

Subscribe