Trend Trading

If it’s your first time registering on the stock exchange, then trend trading will be a good warm-up for your fingers on the trading terminal.

What is trend trading

The price of cryptocurrencies can move in three directions:

- Down: in a bear market, when the volume of closed sell trades exceeds the volume of buy trades.

- Up: in a bull market with a reversal.

- Horizontally: in the absence of a pronounced trend. Such movement of the chart is called “flat”. It signals that a redistribution of forces is taking place and the main players are waiting for a strong entry point to appear.

It is visually easy to determine the direction of price movement: in an uptrend, each candlestick (or bar) opens higher than the previous one. For a downtrend, the next candlestick closes lower than the previous one respectively.

Trend trading means that you buy in an uptrend and sell in a downtrend. That is, you move in the direction of the main flow and therefore, you feel confident.

If you have decided to open your first buy order, then I recommend waiting for the bear market. To buy when the stock bottomed out (or ‘to buy at the bottom’) is the goal of any trader. The crypto market is always going through pullbacks and ups, so you need to be patient and sell the asset after the price recovers. Of course, unless you happen to buy some shitcoin during the dump.

Determining levels for orders

In order for the first trade to be successful and not leave a feeling of incompleteness, it is worth taking the time to determine the entry and exit points.

To do this, Letit offers to use the technical analysis tools that are present in all plans:

MACD indicator;

parabolic SAR;

relative strength index RSI.

In order not to be mistaken, I recommend you to check high-probability trade entry and exit points using several indicators.

The first tool is easy to understand even for the beginners and is included in the basic set of indicators. The second and third require explanation and at least a minimum skill in trading. Therefore, please, refer to our “Education” section and listen to the lessons on technical analysis.

In this article, I will briefly explain the purpose of the first two indicators.

What is the MACD indicator

The trading chart interface of the Letit terminal is identical to TradingView, the most popular service for traders, and it will not be difficult to understand the structure of the panel. If you have no idea what TradingView is, then look at the hint pictures in the article.

TA tools are located in the “Indicators” section

The MACD indicator represents two intersecting moving lines at the bottom of the chart. They move along the zero axis, which is an indicator of the strength of the trend (zero is the absence of a pronounced trend).

One of them is a signal (red or orange), second, blue, is the MACD line itself.

A buy signal is when the blue moving average crosses the red one from the bottom up. Accordingly, a signal to sell is the level where the blue crosses the red from top to bottom.

On short timeframes, MACD indicator signals are delayed

The MACD indicator belongs to the “lagging” group. It provides data on the current market, processing the historical database of timeframes. Therefore, it is convenient to use it when trading with a trend (if it is expressed) or on a sideways drift in the medium term. For high-frequency trading, MACD is not the best choice.

What is Parabolic SAR

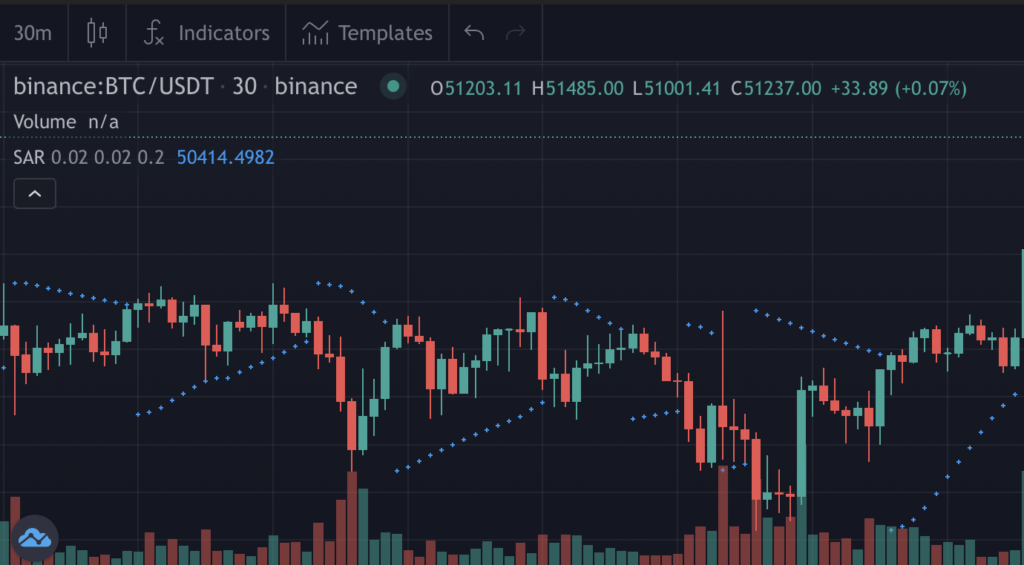

The “parabolic” indicator is activated if you need to determine the levels of entry into the market and exit from it when trading with a trend. Visually, it is a discontinuous parabola consisting of points. Each dot corresponds to a candlestick and shows the boundaries that it is not recommended to go beyond.

With an uptrend, the parabola is at the bottom, with a downtrend, it is at the top. The points of intersection of the Parabolic SAR with the price chart indicate the moment of a possible reversal.

Trading with SAR implies that you can safely enter the market when the lower curve is as far from the chart as possible, and exit at the point of a potential trend change, i.e. as close as possible to the level of intersection of the parabola with the graph.

This analysis tool is used when there is a clearly marked trend. With an uncertain market mood and on a sideways trend, it generates a lot of false signals.

Parabolic also suggests price levels for opening stop loss and take profit during medium-term trading. It is not suitable for scalpers.

It is short-sighted using the Parabolic SAR when the trend has not gained strength and the price movement is not defined

This is what a parabolic looks like in a situation of a pronounced growing trend

Remember that the signal of the indicator is a little behind, so it is wise to close a sell order without waiting for a complete intersection, so as not to miss a reversal.

Join our Linkedin channel to stay updated on the latest news!

Subscribe

Join our Linkedin channel to stay updated on the latest news!

Subscribe